If you’ve ever played free-to-play video games on your phone, you may have seen an advert or two, including mini-games and other content with variable quality and relevance.

That’s the space where Incymo operates; it promises to leverage machine learning and other smarts to maximize advertising revenues for game publishers, promising its users a 30% increase in average revenue per user (ARPU) from new users and a 10% increase to paying customers.

In a market of huge numbers, where every penny counts and every percent can have a tremendous impact on the game companies, those figures caught the eyes of Incymo’s investors.

We decided to take a closer look at its deck to see whether we’d have reached for our checkbooks or the big, red “pass” button.

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

Incymo AI’s deck has only 12 slides, so the company needs to make every slide count. Here’s what’s included:

- Cover slide

- Problem slide

- Solution slide

- Traction slide

- Customer slide

- Business model slide

- Market size slide

- Market trajectory slide

- Goals/targets slide

- Team slide

- “The ask” slide

- Road map slide

Three things to love

There’s a lot to love about Incymo’s slide deck. The design is fresh and it includes many of the key aspects we’d expect to see in a pre-seed deck.

An enormous market

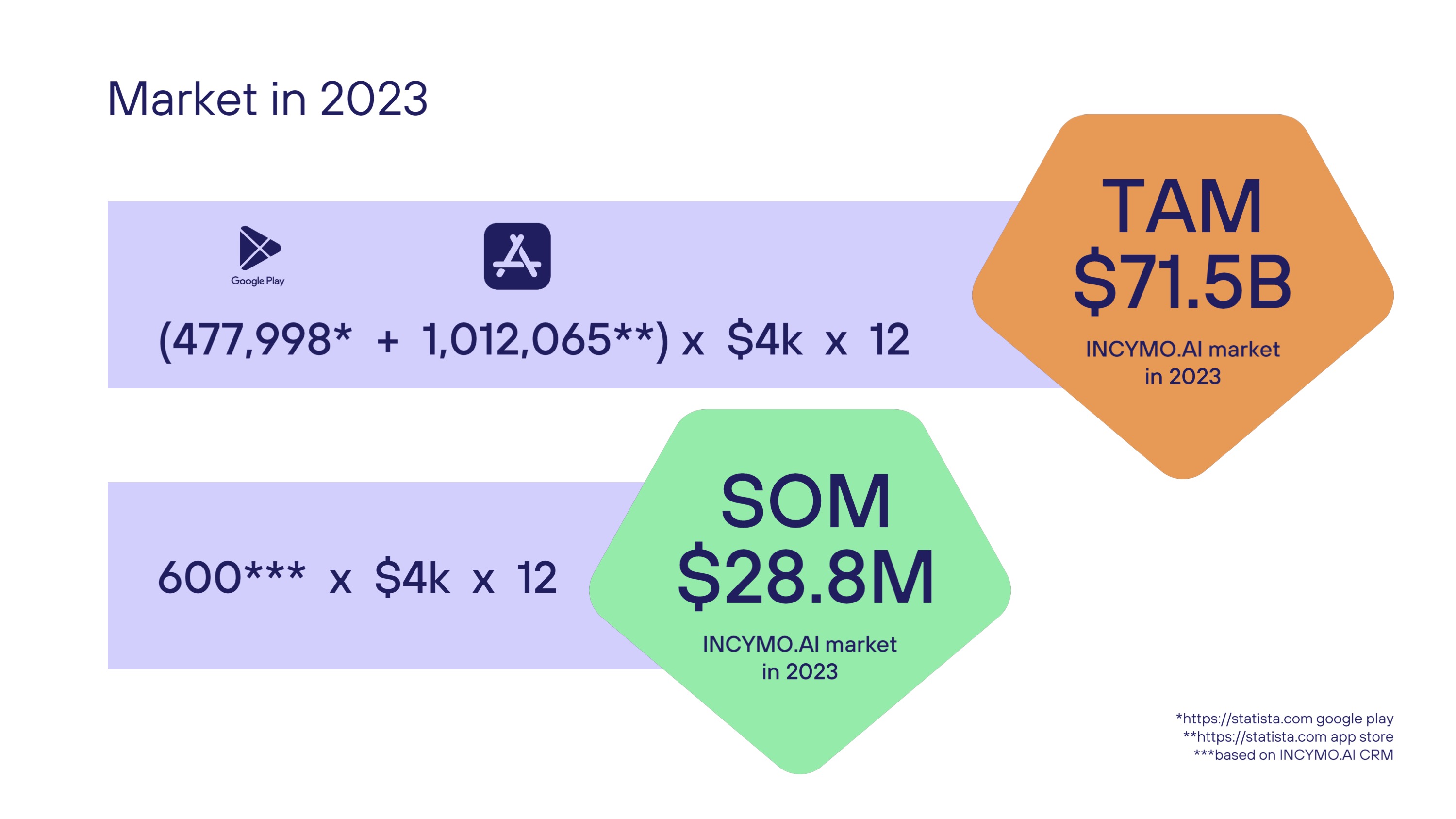

Nobody is going to argue with Incymo that marketing for video games is a big market, and the company gets partial credit for showing off the various ways of calculating the TAM and SOM — in this case, top-down and bottom-up.

Having said that, the top-down calculation seems to be “every game on the Google Play and Apple App store, multiplied by the $4,000 we would charge them per month, multiplied by the number of months in the year.” It’s a bold calculation, and I can see how the company got there, but even if it were to execute with 100% perfection, there’s going to be a huge number of games that can’t or won’t be customers.

The $72 billion per year TAM is hugely naive, bordering on absurd. On the one hand, it doesn’t really matter: The deciding factor is whether the company has a big market, and I agree it probably does. Nonetheless, any executive team that is taking this approach to calculating a TAM is showing its hand as being pretty unsophisticated.

The bottom-down SOM, however, is also pretty unsophisticated. If I’m reading this slide right, the company is essentially saying, “We have 600 people in our sales pipeline, so our obtainable market is to convert all of them at $4,000 per month.” That also isn’t realistic for a number of reasons: No company ever converts all of its leads, and this SOM seems to indicate that there’s a maximum of 600 customers going into the top of the funnel. A company that can’t top up its leads over time is doomed to stagnate.

Look, I 100% believe that Incymo is in a large market and that it can probably find enough customers to make this worthwhile, but the slide deck is an opportunity to show your would-be investors that you understand the financial levers in your business. These slides seem to indicate the opposite; not a great look.

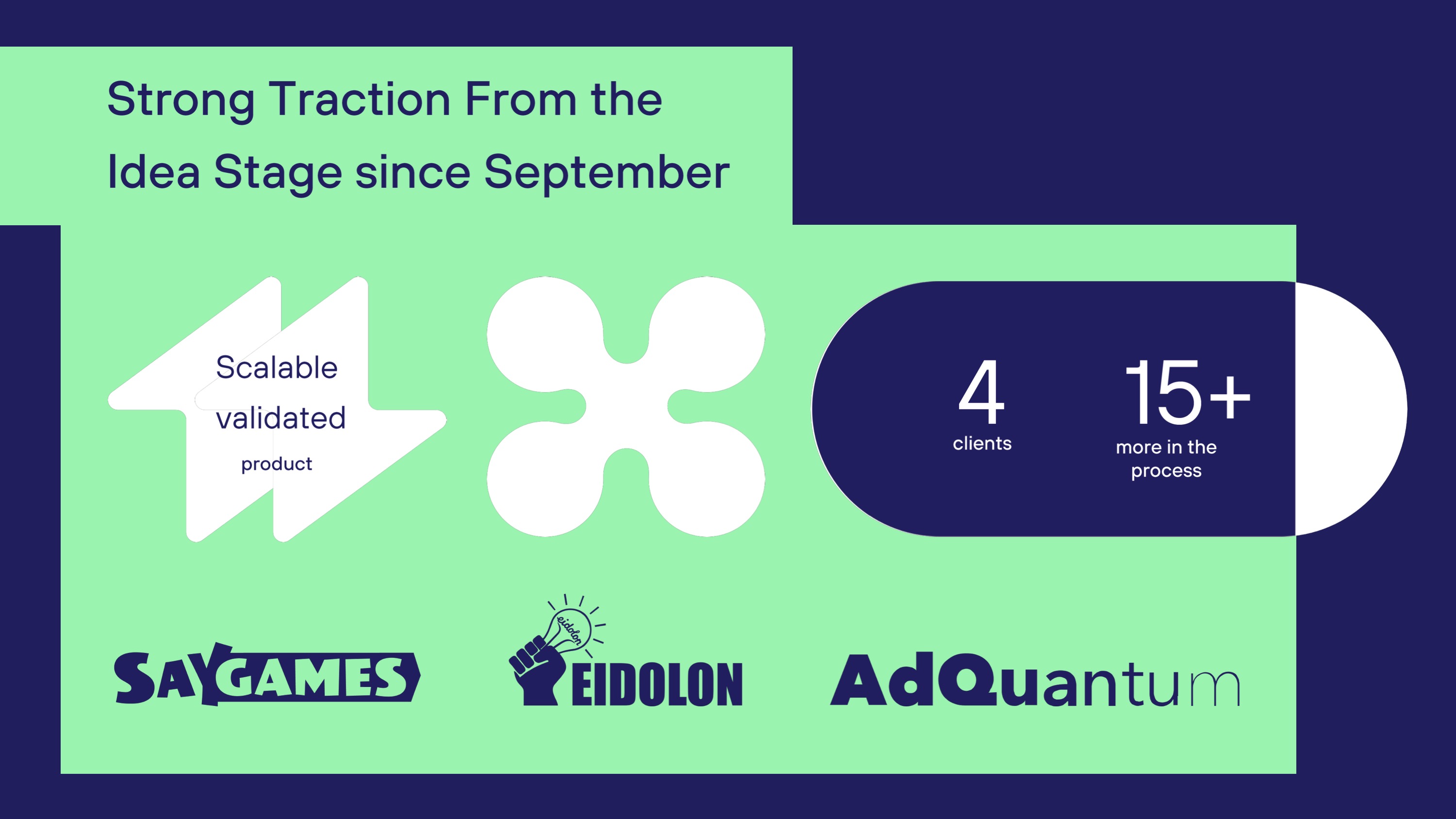

Traction is king

Loving the strong traction headline — it’s one of the things that investors care about more than anything else. I wish the company showed its traction by metrics other than “number of clients” and “more clients in the process” — it would have been more powerful to show revenue or results, for example.

There’s a huge difference between signing up major game studios that want to use your product across its entire portfolio of games and signing up a skunkworks in the same game studio that’s running a pilot and signing up an indie developer. On one of the other slides, Incymo mentions that some of the game companies have $20 million annual marketing budgets. Awesome, but it doesn’t connect the dots to say whether it has actually signed one of those companies.

The other thing I find myself stumbling over on this slide is the “15 more in the process.” That means very different things to different companies. Anyone who’s done B2B sales knows that a healthy sales pipeline is the alpha and omega of a successful sales operation. Having someone “in the process” could mean anything — and without closer qualification, it’s dangerously close to being yet another vanity metric.

A somewhat clearly defined problem/pain point

There’s little doubt that marketing for mobile games is cutthroat and supremely competitive. The difference between the No. 3 and No. 6 slots on the app charts is vast, and a lot of these companies are spending eye-watering amounts of money to fight their way to the top.

I 100% believe it when the company says that it has found that its target customers (gaming user acquisition marketers) are spending a lot of time iterating on ads that perform well. A sample size of 20 seems a bit low for this slide, so I’d love to have seen some slightly more comprehensive numbers, but that doesn’t reduce the clarity of the problem statement. (Though the grammar leaves a thing or two to be desired.)

So. Those were some of the positive things we found about this pitch deck, and you perhaps noted we still added caveats. In just a moment, we’re about to get a lot saltier and look at a few things Incymo could have improved or done differently, along with its full pitch deck!

Strap in; it’s going to be quite the ride.

A few things that could be improved

Not sure what the story is here

When I started looking at this slide, I had to put it away for a moment; it was giving me a headache. Here are a few notes that might outline why:

For one thing, I’m not sure what these numbers actually mean, and the sources (Statista and Yahoo Finance) are enormous — I wasn’t able to find any obvious numbers that the $75.6 billion or the $235.1 billion referred to.

Is it all spending on mobile games? (No, that seems to be $110 billion.) Is it the in-game mobile advertising market? (No, that seems to be around $6.8 billion). What’s that compound annual growth rate (CAGR) referring to? In-game advertising? (No, that seems to be 35%). Presenting numbers that are devoid of context is bad practice overall.

Incymo seems to have decided that it has 10% of the entire games market spend, both now and in the future. I’m unclear what the first number is, and so I’m doubly confused about how it seems to believe it can get a 10% market share.

The math doesn’t seem to add up: A rise from $76 billion to $235 billion is a 210% increase, but there are only six years between 2022 and 2028, which is a CAGR of around 21%, give or take. If we’re generous and say it’s actually from 2023 to the beginning of 2028 and call it four years, that’s a CAGR of 33%. So I still don’t understand where the 54% number came from.

Also, let’s talk about those graphs. The top bar is 560 pixels wide on my screen, and the bottom graph is 720 pixels or so. That’s a 28% increase for a graph that’s meant to illustrate a 210% increase.

In a nutshell, this graph doubles down the worry I had from Slide 7 and makes me very seriously doubt whether the startup understands the numbers for the industry it is operating in.

Is it a little anally retentive to check the numbers on a chart slide this carefully? Absolutely. But know this: Many investors are numbers-driven people — they are in the financial services industry, after all — and they are evaluating founders on whether they can see themselves in board meetings with them. As an angel investor, I’ve already 90% decided not to take a meeting with this company based on the cluster headache I got from this slide deck — and I doubt I’m the only person to feel that way.

Sweat the details. They matter.

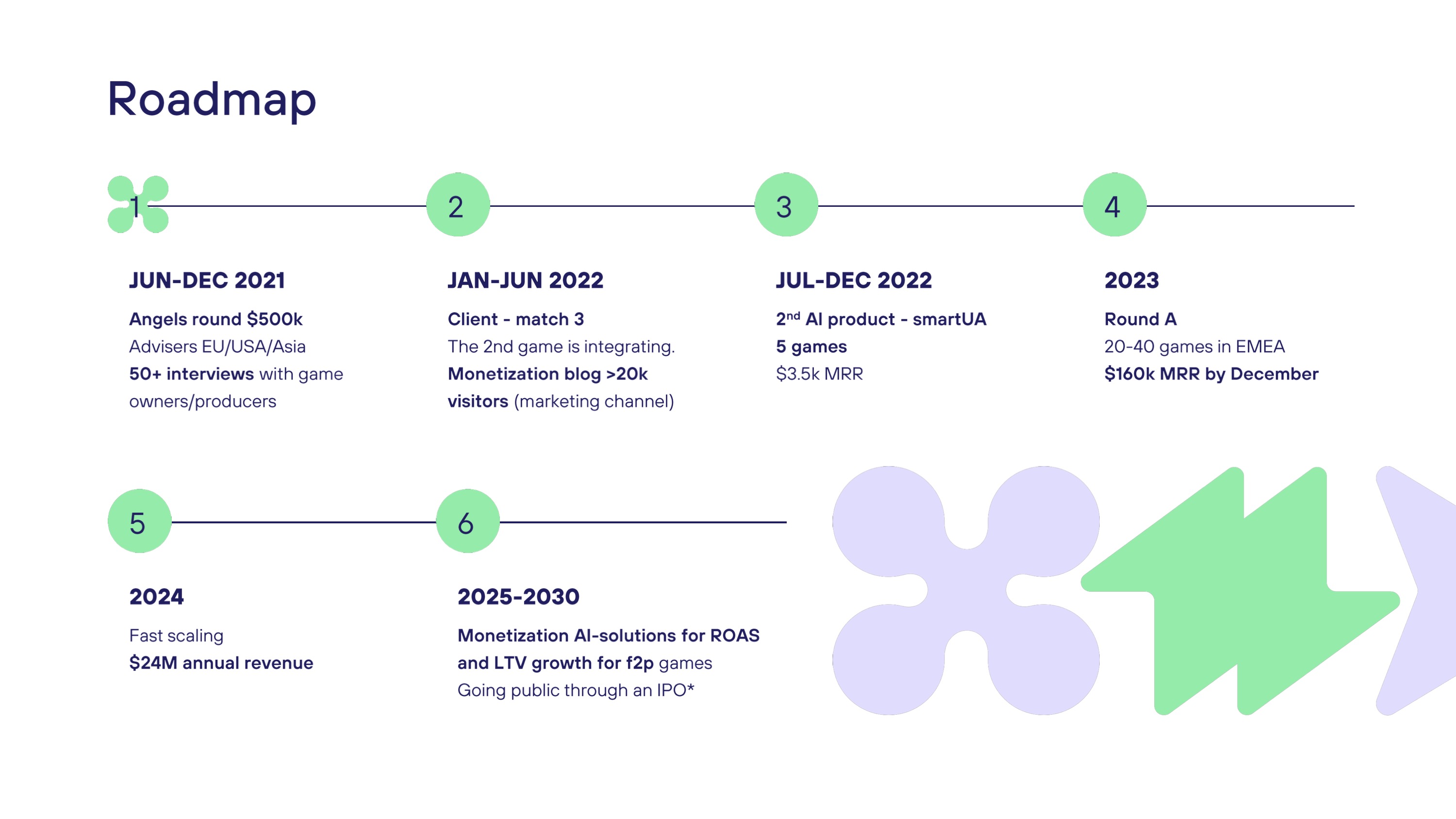

Make me believe it!

I love me a good road map, and there’s a really powerful path to success here. However, I’m not sure if I believe it: The company is making some claims around metrics that don’t really matter. Yes, more than 50 customer interviews are important. Yes, having visitors to your blog is impressive. But neither of those are core business metrics that will truly move the needle.

This deck is missing a go-to-market slide, so while I celebrate the company saying it will have 20 to 40 games on its platform by the end of 2023 and scaling to $24 million in annual revenue by the end of 2024, there’s nothing here that makes me think, “Yes, this is a reasonable plan.” There’s no operating plan to show how the company is planning to get from five to 40 games.

On the previous slide, it says “$300k in investment to reach the KPI from a16z and close round A in 2023,” which is missing a whole lot of context. Does that mean that Andreessen Horowitz will invest if the company hits certain KPIs? What are these KPIs? How is the company tracking toward them? And will $300,000 really be enough to get there?

There are simply too many different plans and numbers that don’t seem to crystallize into a coherent narrative. As a potential investor, I would have a lot of questions about the company’s strategy and progress before I’d feel comfortable writing a check.

Finally, listing “going public through an IPO” on your slide makes sense in one universe: That should be the goal for every startup in the long run, but a much more likely outcome for an adtech company like this one is that a direct or adjacent market competitor will acquire it as it starts to get the huge amounts of traction it is suggesting it will have by the end of 2024. In short: Ixnay on the exit-ay.

The full pitch deck

If you want your own pitch deck teardown featured on TC+, here’s more information. Also, check out all our Pitch Deck Teardowns and other pitching advice, all collected in one handy place for you!

Comment