The tsunami of sustainability disclosures facing American multinationals: Is your company prepared?

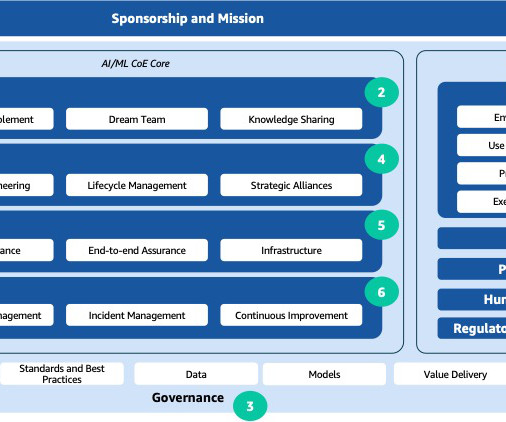

IBM Journey to AI blog

SEPTEMBER 15, 2023

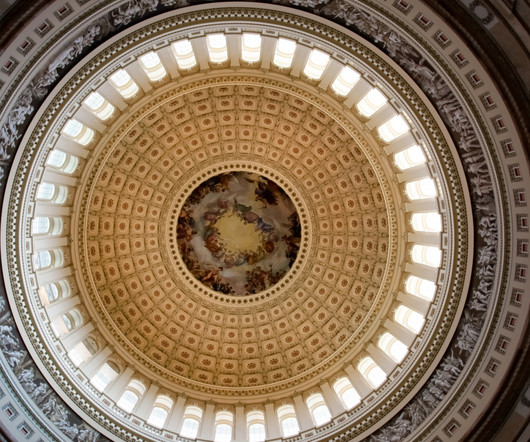

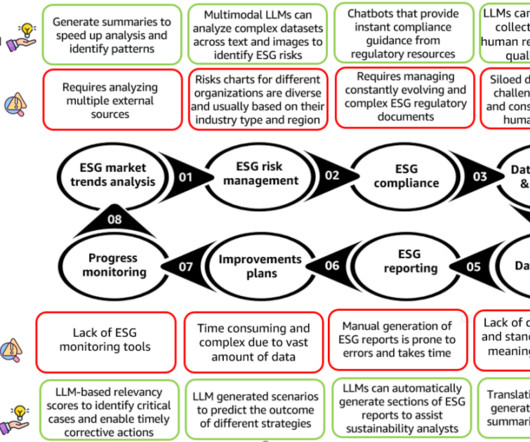

Securities and Exchange Commission (SEC) is in the process of finalizing climate related disclosure requirements. These requirements will likely mandate publicly traded companies to disclose their greenhouse gas (GHG) emissions footprint, climate-related goals, and progress, as well as climate-risk related financial impact and expenditures.

Let's personalize your content