Forging a framework for central bank digital currencies and tokenization of other financial assets

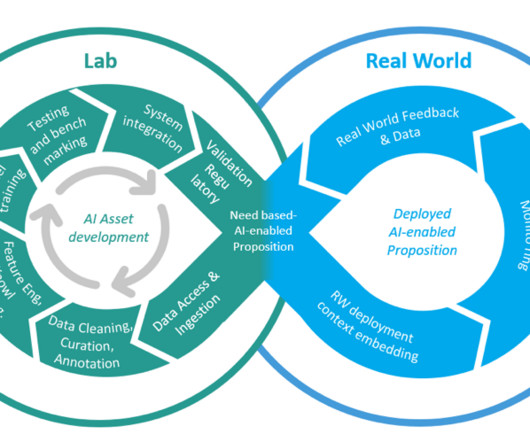

IBM Journey to AI blog

FEBRUARY 1, 2024

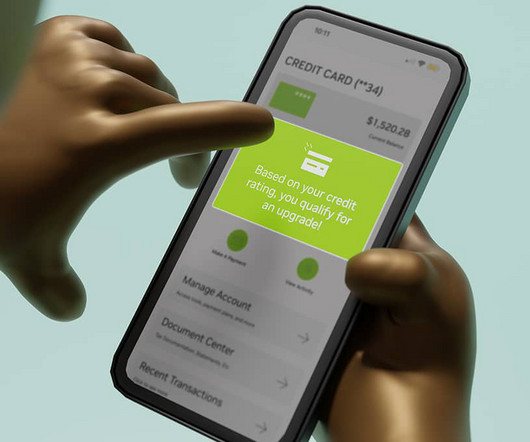

More prominently, central bank digital currencies (CBDCs) have come to offer digital forms of central bank money, while tokenized deposits tokenize the lifecycle of commercial bank money in both the retail and wholesale context. What are central bank digital currencies? This can be interpreted in various ways.

Let's personalize your content