Business process reengineering (BPR) examples

IBM Journey to AI blog

APRIL 25, 2024

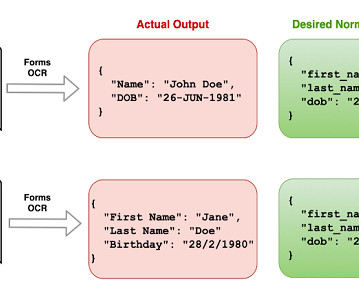

Steps of business process reengineering for CRM include integrating customer data from disparate sources, using advanced analytics for insights, and optimizing service workflows to provide personalized experiences and shorter wait times. IBM Wow Story: Finance of America Promotes Lifetime Loyalty via Customer-Centric Transformation.

Let's personalize your content